Tools

Information

Contacting Us

- - Xero- Business Central- QuickBooks Online

Product

About Us

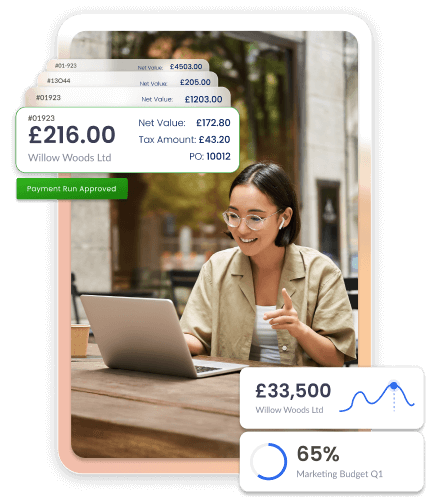

Accounts Payable Automation

Cut Your AP Costs &

Streamline WorkflowsStay organised and speed up month-end with Zahara. Automate AP, reduce hassle, and free up time for what matters.

Tired of chasing approvals, fixing errors, and managing paper invoices?

- Reduce AP processing time by up to 50%

- Eliminate manual invoice entry and approval delays

- Speed up month-end close and improve cash flow visibility

- Stop duplicate invoices and reduce costly errors

Try Zahara Free for 30 DaysTrusted by finance teams to improve efficiency, visibility and compliance.

A Messy, Disconnected AP Process

Juggling multiple apps just to manage accounts payable? Manually matching invoices, chasing approvals, and switching between systems slows everything down, increases errors, and makes month-end a nightmare.

You’re not alone. Many businesses face the same chaos, with manual processes bogging down efficiency and creating opportunities for costly mistakes. But here’s the good news—there’s a simple solution that could transform everything: purchase orders. When used effectively, POs cut through the mess, providing a clear, accountable, and efficient procurement process. And that’s exactly what Zahara’s Purchase Order Software delivers.

Struggling to manage spending across purchase orders, budgets, and suppliers?

Many businesses rely on a patchwork of tools to handle different AP tasks—one for invoices, another for approvals, and a separate system for payments. The result? A scattered, inefficient process that wastes time and resources.

Zahara keeps everything in one place. No more chasing approvals or fixing costly errors.

The Solution...

Keep your entire AP process in one place with Zahara. With purchase orders, multi-step approval workflows, OCR invoice processing, and supplier payments to over 40 countries, everything flows seamlessly—no more juggling multiple apps.

Zahara connects effortlessly with popular finance systems, and for those using bespoke or on-premise tools, we offer flexible ways to sync data in and out. However you work, Zahara keeps your AP organised, efficient, and stress-free.

Approve purchases before they happen with multi-step PO workflows. No more surprises.

Have a read our AP automation guide? Download hereSo why Zahara?

Zahara isn’t just another software solution—it’s the key to transforming the way your business manages spending. From purchase orders to supplier management, budgets to fraud prevention, Zahara helps finance teams work smarter, not harder.

Zahara’s user-friendly platform helps businesses regain control over their finances and procurement, providing the tools you need to save time, reduce errors, and eliminate unnecessary spending. The end result? A more efficient, accountable, and financially secure organisation.

Take control of your company’s spending today and see the Zahara difference for yourself.

How Zahara Works.

How We Work.

1. Buy Better With POs

Know your costs upfront with strict budgets and multi-step approvals to control spending.

1. Buy Better With POs

Our software helps you get on top of costs. As your organisation grows, it's important to remember your small-business principles and not allow costs to run away from you.

Know your costs before you commit to spending. Set strict budgets for particular departments or projects and use multi-step approval workflows to decline, amend, or approve purchase orders.

Find out about Invoice Processing with ZaharaI thrive on copy-pasting data between platforms.

Said no one ever

2. Receipt goods with ease

2. Receipt goods with ease

If your teams can easily mark off as received the things they have bought, adopting Accounts Payable Automation becomes easier for the finance team. Zahara has deliveries and receipting on the mobile app so it's never been easier.

Zahara’s reporting and analysis shows you who’s buying what, when, and from who. With a complete audit trail and the ability to record GRNs, you never have to wonder which step is holding up the process.

Find out about Invoice Processing with ZaharaZahara helps you set clear budgets for departments and projects, keeping spending on track and approvals informed.

I enjoy cross-checking delivery notes and invoices by hand.

Said no one ever

3. Say "Goodbye" to Manual Data Entry

Process invoices 9x faster with Zahara—automated invoice reading and precise coding handle the details for you.

3. Say "Goodbye" to Manual Data Entry

One of the key pillars of accounts payable automation is the ability to get your supplier invoices approved and validated and into your finance system with minimal effort. This means fast and intelligent reading of the invoices and matching against any outstanding purchase orders.

The end result is you can pay your invoices 9 times faster, with less effort on your part. Zahara can accurately read your invoices for you, down to the line item level, applying all the correct coding.

Find out about Invoice Processing with ZaharaI just love keying invoices manually.

Said no one ever

4. Approve, Export, Pay

4. Approve, Export, Pay

Paying bills is the final part of the accounts payable automation process. Whether it's domestic or FX, having a secure system linked to the invoices that need paying, where payments can be effected quickly and payment statuses reflected in your finance system has to be an improvement over manual process.

Paying bills more easily with less effort will free up time for your team to analyse spend and focus on cost savings. With Zahara you can track every invoice from receipt to approval and then into your finance system for payment.

Find out about Invoice Processing with ZaharaMake bill payments seamless and secure with Zahara. Automate approvals, sync with your finance system, and free up your team to focus on cost savings.

I live for month-end panic.

Said no one ever

Accounts Payable Automation FAQs

Everything you need to know about how Zahara’s AP Automation can help your business save time, reduce errors, and improve control.

What is Accounts Payable Automation, and why do businesses need it?

Accounts Payable Automation is a software solution that streamlines and automates the processes involved in managing supplier invoices and payments. Businesses use it to reduce manual data entry, improve accuracy, speed up approvals, and maintain control over finances.How does Accounts Payable Automation work, and what are its key features?

It captures, processes, and routes invoices electronically. Key features include invoice scanning, data capture, approval workflows, and integrations with accounting systems like Xero, Sage, and Microsoft Dynamics.What are the benefits of implementing Accounts Payable Automation for my business?

- Faster invoice processing

- Fewer errors and missed payments

- Better visibility of financial data

- Improved compliance and audit readiness

- Cost savings from reduced manual work

Is Accounts Payable Automation suitable for businesses of all sizes?

Yes. Zahara is scalable and works for startups, SMEs, and large enterprises. Regardless of size, you can benefit from reduced admin, stronger financial control, and easier compliance.What are the top 5 benefits of AP Automation?

- Faster processing and approvals

- Increased accuracy with less manual input

- Real-time visibility of spend

- Improved fraud prevention and control

- Fully documented, auditable processes