Business Unit Category

Add an email signature

Coding Restrictions

Create new Business Unit

Custom Fields on Line Items

Customised labels

Date formating

Default delivery address

Division Management

Editing Email Templates

How to hide cost codes

Invoice email forwarding – Microsoft 365

Pros and Cons of Using Zahara’s Inbuilt Email Service vs. Your Own SMTP

SMTP & Email Sending

T&C on your PO Template

Invoice Processing Help Category

Auto reject supplier invoices

Auto rejecting of invoices issue

Finding an order or invoice

How to create a credit note

Invoice email forwarding – Microsoft 365

Invoice export colours

Invoice Inbox

Invoice List View

Invoice matching

Invoice Processing Explained

Month end cut offs

Negative Order Balance

Setting up Autopilot

Supplier Matching

Waiting for a GRN

Purchase Orders Category

Adding a product to an order

Adding documents to an order

Bulk importing orders

Close Orders Automatically

Closing an order

Copy PO to Buyer

Creating a Purchase Order

Deleting a PO

Duplicate Order Prevention

Editing an order

Finding an order or invoice

GRN an Order – Learn with this Guide

Grouped Purchase Orders

Import Line Items

Negative Order Balance

PO Template Editing

Product Centric Buying

Purchase Order Numbering

Purchase Order PDF

Purchase Order Prefix

Purchase Requisition Number

Quick Create a Purchase Order

Send PO to Supplier

Supplier order acceptance

What is a Purchase Order?

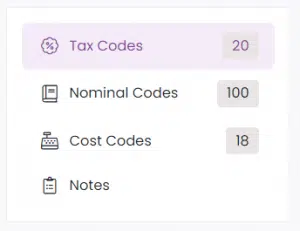

To access coding, click the Business menu and Coding Lists. This incorporates Tax Codes, Nominal Codes and Cost Codes.

Tax Codes

If you reclaim back your expenditure taxes you may want to set up tax codes. We allow for as many tax codes to be created as required. If you don’t reclaim your tax, you may want to set one code of zero, with a 0% rate and set it as the default.

If you are in Europe and have VAT or Australia/Canada with GST then you will probably re-create the same tax rates as in your accounts system. If connected to a finance system, you will want to sync codes into Zahara.

Nominal Codes

Often referred to as Ledger codes or Account codes, nominal codes are the same thing to Zahara. This is an accounting term, to allocate your spend to the correct coding. You can import or sync nominal codes. We recommend integrity with your finance system and only import or sync codes that already exist. Avoid originating any codes in Zahara that are orphaned from your finance package.

Cost Codes

Cost Codes are functionally arbitrary but allow you to further allocate your spend. You have your Nominal Code, for example, – “5050 – Stationary” but in addition you could have Cost Codes for paper, pens or envelopes. You can create whatever you need. This will largely be decided by your finance system and the Cost Code will be named to suit and aligned with an already existing coding set – ie Xero Tracking Category or Sage Department.

On the left hand side of the Coding Lists page, you are able to switch between the codes that you have permission to view. In addition to these tabs is the new Notes page.

The codes are displayed in a table with relevant columns. You are able to sort the lists by each column either ascending or descending by clicking the name of the column. You are also able to filter the lists by either typing in the text box – which searches through all columns, or displaying only active, or inactive codes.

The notes tab allows you to view any changes made to the coding lists – who made the changes, what they changed and when. At the bottom of the page, you are also able to add custom notes to save any information you need for the future. These notes can be deleted to clear clutter, but can always be re-activated to ensure a complete audit trail at all times.

The process of creating a new code is largely the same for the three different types. First click the New Code button next to the title and a box will appear, allowing you to populate information for your new code.

For Cost and Nominal codes, you enter the code itself, as well as its description. You can also decide whether or not to bring this code across to all your business units.

For Tax Codes, you enter the code, its name and percentage. You can also decide whether it is created active or not and whether it is the default tax code for your business. The default tax code will be marked on the list with a star icon.

You are also able to create codes through importing a CSV file, or syncing with additional accounting software such as Sage, Xero, MYOB or QuickBooks Online.

Importing

To import codes, click the arrow next to the New Code button and select Import Codes. This will take you to the import page. Hit upload to bring your CSV into Zahara, or download our template for populating yourself.

You can then choose which column in your CSV maps to which field in the list. A preview on the right hand side will guide you. You can then choose whether or not to bring these codes across to all of your business units. Hit Import Codes and you’re all done.

Syncing

The final way to create codes in Zahara is to sync with your existing accounting software. To do this, just hit the Sync button in the top right and wait for the synchronisation result to appear.

You can edit your codes on a line by line basis, or in a batch.

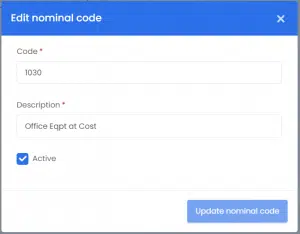

To edit on a line, simply click the edit button to the right of the code. This will bring up a screen allowing you to change, and save any fields in the code.

Alternatively, if you tick boxes for multiple codes on the left hand-side you can edit multiple by using the Update button. Choose which fields you want to change and what you want to change them to. Then hit Update Codes.

Finally, you can delete your codes by ticking them on the left hand-side and using the delete button in the top right corner. Deleting codes, unlike notes is permeant and irreversible. The note itself however, denoting the deletion, is permeant so you have a record of what was deleted and when.

I am unable to edit or update codes/I can’t see the edit button? You likely do not have the Update permission for the code in question. Discuss with your tenancy admin to have this permission added to your account.

I can’t create/upload codes? You may not have the ‘Create’ permission for the code in question. This is needed to both create manually, and upload codes. Discuss with your tenancy admin to have this permission added to your account.